Q3 2024 EVM HealthTech Industry Insights Premium Report

Did you know that HealthTech funding in Emerging Venture Markets (EVM) dropped by 77% YoY in 9M 2024, marking the lowest level since 2019? Despite this, key sub-industries like Medical Devices saw the smallest decline and rose to the top in terms of deal volume. Our comprehensive 9M 2024 EVM HealthTech Report dives into regional funding trends, top countries by deals, and leading investors to provide the insights you need to navigate this evolving landscape across MENA, SEA and Africa.

Unlock valuable insights into HealthTech’s evolving venture capital landscape across MENA, SEA and Africa. Book a Free Demo Today and explore our premium data for a more detailed and in-depth analysis.

Check out our Q3 2024 MENA Venture Investment Premium Report for the latest trends and insights on MENA’s VC landscape.

For a country deep-dive, check out our Q3 2024 UAE Venture Investment Premium Report and Q3 2024 KSA Venture Investment Premium Report.

Summary of the Report’s Findings

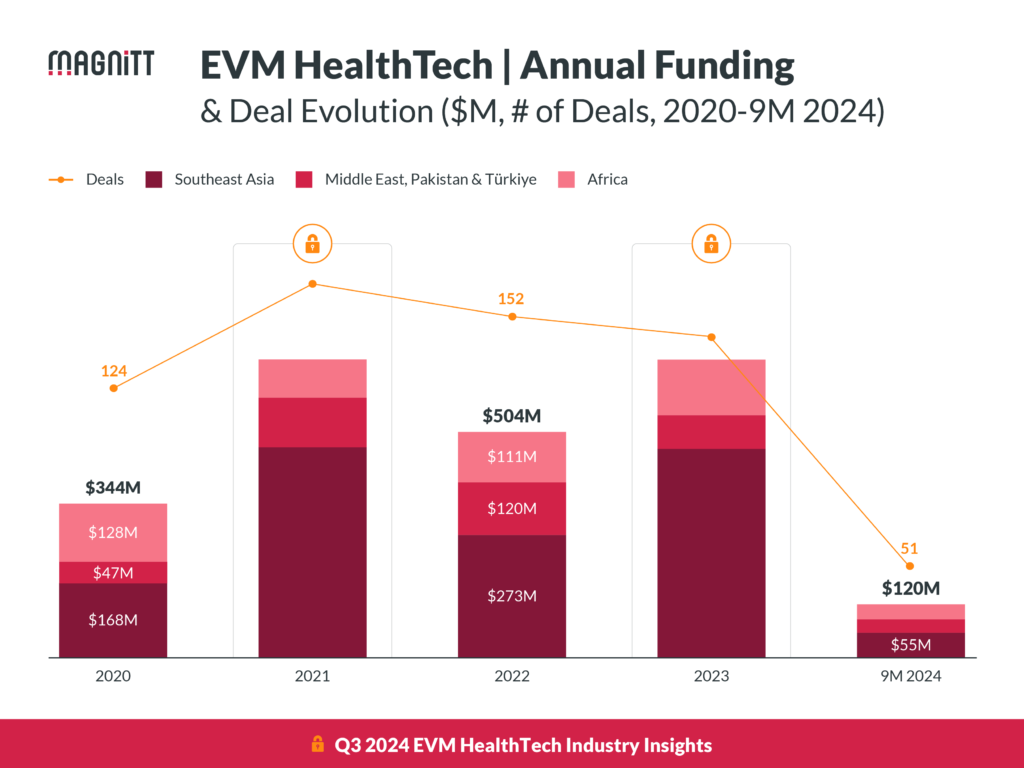

In the first nine months of 2024, EVM HealthTech funding dropped to $120M, representing a sharp 77% YoY decline, with the total number of deals falling by 51% to just 51 transactions. This marks the lowest funding level since 2019, driven by the absence of MEGA deals and a steep decline in Series B funding which fell from $200M in 9M’23 to zero in 9M’24. Despite the broader market challenges, Medical Devices and Female Health showed resilience, seeing the smallest declines among top sub-industries.

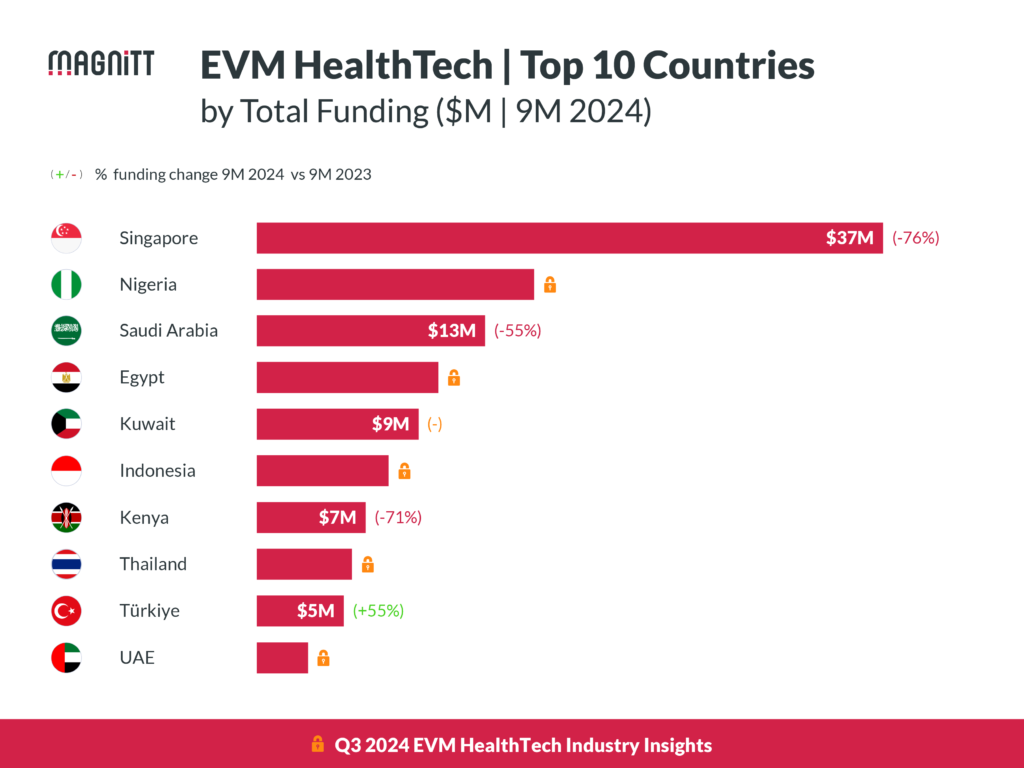

Regionally, Southeast Asia (SEA) accounted for the largest share of HealthTech funding, capturing 46% of total EVM funding. Singapore led in deal activity, contributing 16% of total EVM transactions, despite a 60% YoY drop in deal numbers. MENA followed closely, recording the smallest regional drop in both funding and deals, reflecting relatively stronger investor sentiment compared to SEA and Africa.

The leading investors in HealthTech included the Bill & Melinda Gates Foundation, which ranked as the top investor by capital deployed. East Ventures and SEEDS Capital emerged as the most active investors by deal count, each leading with three deals.

Want access to more valuable and unique insights like these? Book a Free Demo Today to get access to our comprehensive data and learn how it can inform your investment strategies. Or download our Free Q3 2024 Emerging Venture Markets Summary Report for a broader view of the Emerging Venture Markets (EVMs) covered by MAGNiTT.

Noteworthy Insights from Q3 2024 EVM HealthTech Industry Insights Premium Report

- $120M Total Funding (-77% YoY): EVM’s HealthTech sector recorded $120M in total funding in 9M 2024, marking a 77% decline compared to the previous year. The absence of MEGA deals and a steep decline in Series B funding contributed to this sharp drop.

- Singapore Leads in Deals: Singapore emerged as the most active market by deal count, capturing 16% of all HealthTech deals across EVMs, despite a 60% YoY decline in deal numbers. Indonesia was the only country to record a YoY rise in deal activity.

- Medical Devices and Online Booking Dominate: Medical Devices became the top sub-industry by transaction volume, representing 22% of all deals, while Online Booking & Consultations remained the top-funded sub-industry despite an 86% decline in funding.

Want access to deeper insights on specific countries across MENA, SEA , Africa, Türkiye and Pakistan? Book a Free Demo Today with our team today and discover how MAGNiTT’s comprehensive data can empower your investment decisions.

HealthTech Top Countries by funding and Emerging Industry Trends across EVM

Pro Tip: Subscribers can access the Platform’s Advanced Analytics tools to make customized cuts by country, industry, stage, and many more filters spanning MENA, Africa, South East Asia, Türkiye, and Pakistan. Contact our sales team to learn more.

EVM HealthTech faced a challenging 9M 2024, with funding dropping by 77% YoY and deals declining by 51%. This sharp decline was propelled by a drop in MEGA deals and Series B funding. Southeast Asia, however, accounted for 46% of total HealthTech funding, led by Singapore, which captured 31% of EVM funding despite a 71% YoY drop. Kuwait experienced the most significant ranking jump, climbing 17 spots driven by a Series A deal with Ayadi Health.

In MENA, Saudi Arabia (KSA) and Egypt led funding activity, with KSA accounting for 32% of total MENA HealthTech funding. The UAE saw an 83% YoY decline, largely due to the absence of large deals like Alma Health, which raised $10M in 9M’23. In Africa, Nigeria led the continent in funding accounting for 48% of the total funding driven mainly by an $11M deal from Field Intelligence. Kenya, which saw the least funding and biggest decline, led in deal volume in Africa alongside Nigeria with 4 deals each, reflecting 33% and 60% YoY decline in deals, respectively.

Don’t miss out on these crucial insights. Download the Q3 2024 EVM HealthTech Industry Insights Premium Report now to get the full picture. To explore more advanced insights, Book Free a Demo Now with our team at MAGNiTT.

Who is it for?

Whether you’re a private investor, a VC, an investment company, a CVC, or working in corporate, this report gives an overview of the ecosystem. It caters to a diverse audience, including any curious minds who want to use this report’s yearly, quarterly, and monthly charts to track investment activity.

You can also see which country and industry the investment activity focused on deals and capital deployed, allowing you to leverage insights and make wise choices.

The report can also be used by consultants looking to identify technology innovation trends and who will find it valuable to look at the evolution of M&A activity and concentration of acquirers/acquired startups.

Last but not least, government entities searching for investment opportunities will also find valuable information to make informed decisions.

Where is this information from?

The report was created using data from MAGNiTT. MAGNiTT is the leading VC-verified data platform and offers a comprehensive directory of technology innovation trends. Our unique SaaS solution includes investment directories listing startup venture funding across the Middle East, Africa, Pakistan, Turkey, and now Singapore. By using MAGNiTT, you will also get access to market sizing tools to visualize investment growth and trends across various industries, geographies, and stages, as well as comparison tools for benchmarking geographies, industries, and investor performance. Furthermore, MAGNiTT offers exit comparisons by examining mergers and acquisitions.

Learn more about MAGNiTT’s Data Methodology.

Latest Research

Q3 2024 EVM HealthTech Industry Insights Premium Report

EXPLORE OUR PRICING Q3 2024 EVM HealthTech Industry Insights Premium...

Read MoreQ3 2024 UAE Venture Investment Premium Report

Q3 2024 EVM HealthTech Industry Insights Premium Report Premium Report | October...

Read MoreUI vs. UX: What’s the difference?

Completely formulate integrated methods Globally maintain multifunctional products before ubiquitous...

Read More