Q3 2024 EVM HealthTech Industry Insights Premium Report

Did you know that HealthTech funding in Emerging Venture Markets (EVM) dropped by 77% YoY in 9M 2024, marking the lowest level since 2019? Despite this, key sub-industries like Medical Devices saw the smallest decline and rose to the top in terms of deal volume. Our comprehensive 9M 2024 EVM HealthTech Report dives into regional funding trends, top countries by deals, and leading investors to provide the insights you need to navigate this evolving landscape across MENA, SEA and Africa.

Unlock valuable insights into HealthTech’s evolving venture capital landscape across MENA, SEA and Africa. Book a Free Demo Today and explore our premium data for a more detailed and in-depth analysis.

Check out our Q3 2024 MENA Venture Investment Premium Report for the latest trends and insights on MENA’s VC landscape.

For a country deep-dive, check out our Q3 2024 UAE Venture Investment Premium Report and Q3 2024 KSA Venture Investment Premium Report.

Summary of the Report’s Findings

In the first nine months of 2024, EVM HealthTech funding dropped to $120M, representing a sharp 77% YoY decline, with the total number of deals falling by 51% to just 51 transactions. This marks the lowest funding level since 2019, driven by the absence of MEGA deals and a steep decline in Series B funding which fell from $200M in 9M’23 to zero in 9M’24. Despite the broader market challenges, Medical Devices and Female Health showed resilience, seeing the smallest declines among top sub-industries.

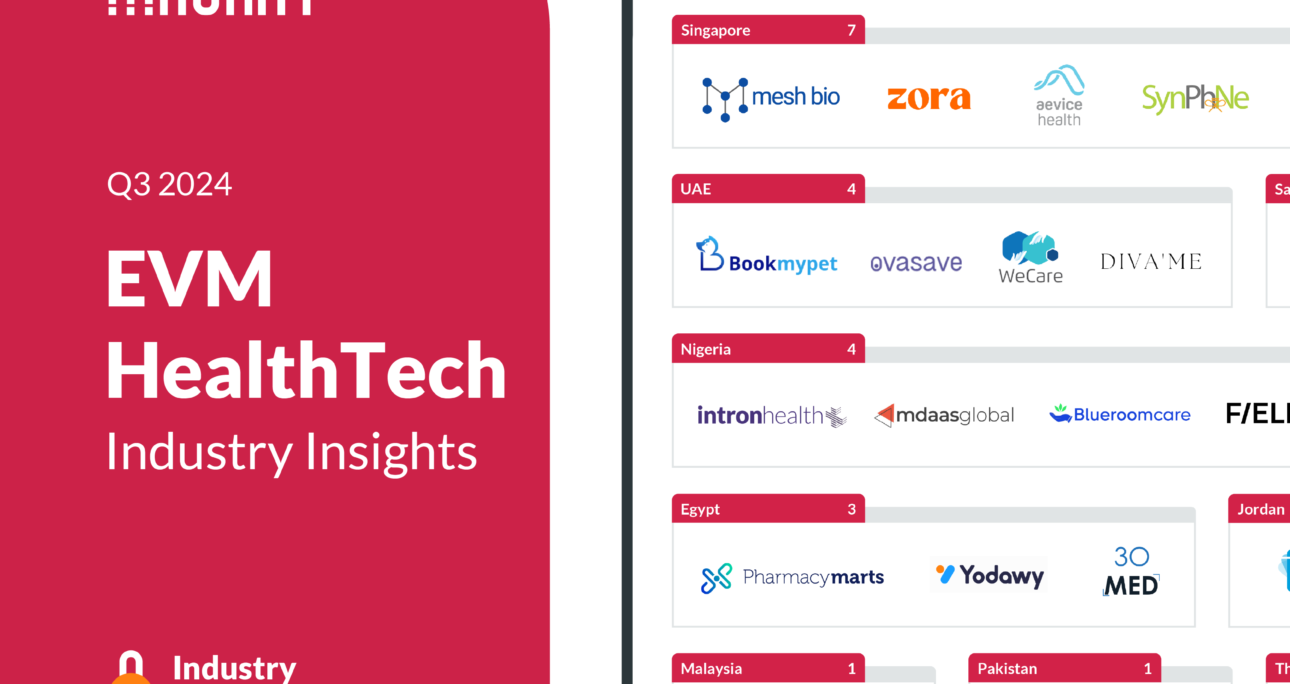

Regionally, Southeast Asia (SEA) accounted for the largest share of HealthTech funding, capturing 46% of total EVM funding. Singapore led in deal activity, contributing 16% of total EVM transactions, despite a 60% YoY drop in deal numbers. MENA followed closely, recording the smallest regional drop in both funding and deals, reflecting relatively stronger investor sentiment compared to SEA and Africa.

The leading investors in HealthTech included the Bill & Melinda Gates Foundation, which ranked as the top investor by capital deployed. East Ventures and SEEDS Capital emerged as the most active investors by deal count, each leading with three deals.

Want access to more valuable and unique insights like these? Book a Free Demo Today to get access to our comprehensive data and learn how it can inform your investment strategies. Or download our Free Q3 2024 Emerging Venture Markets Summary Report for a broader view of the Emerging Venture Markets (EVMs) covered by MAGNiTT.